|

|

|

|

What is the Quarterly Unemployment E-File Creator and How is it Used?

The E-File Creator is a program that creates your Quarterly Unemployment Return in a file that that can be electronically sent to the State. This program eliminates the need to print and mail in your return.

Program works with QuickBooks Pro, Premier, Enterprise and Simple Start.

Works with unlimited company files.

Which States are supported?

Connecticut, Florida, Illinois, Kentucky, Maryland, Massachusetts, Mississippi, North Carolina, South Carolina, Tennessee and Texas. More states to come soon.

How much does it cost?

Program cost $89.00 Per Year.

How Does the program Extract Data From QuickBooks?

Program extracts the data from QuickBooks using XML from the QuickBooks company file that you have opened and uses the information to create a file that can be electronically sent to the State.

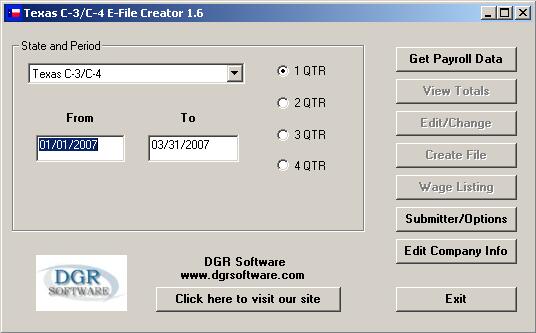

Using the program is As Easy As...

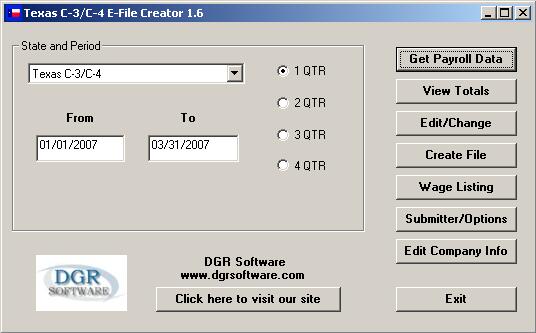

- Start QuickBooks and Open up a company file.

- Specifying the quarter.

- Clicking on the GET Payroll Data button which starts the data extraction process from your QuickBooks data files.

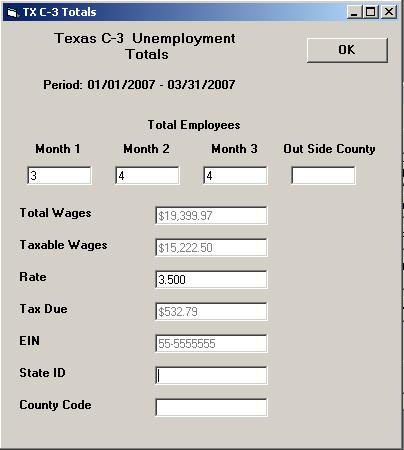

- Clicking on the View Totals button to review Total Wages, Rate and Employee counts.

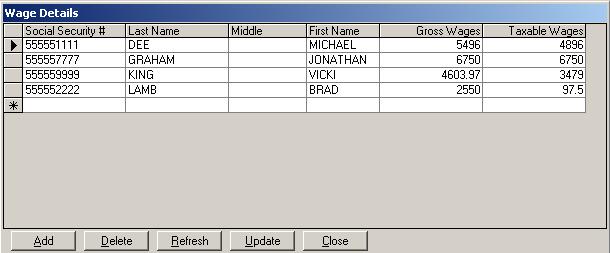

- Clicking on the Edit/Change button to change, add or delete employees.

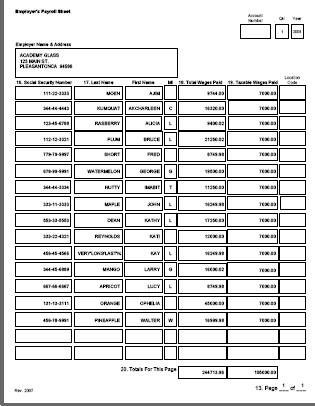

- If you need a hard copy for your records, then click on the Wage Listing button to print employee wages.

- Clicking on the Create File button to create the file.

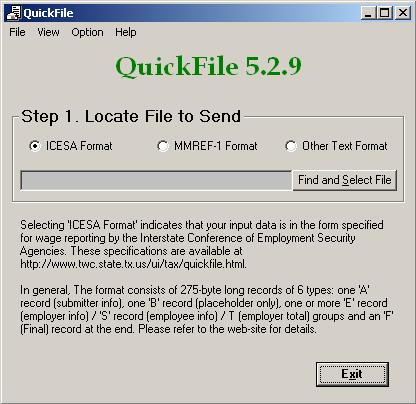

- After the file is created, then all you do is send the file to the State. Texas users have to start the Texas Workforce Commission QuickFile program and send the file.

System Requirements

-

QuickBooks Pro, Premier, Enterprise or Simple Start

-

22 Megabytes - Hard disk space

-

32 Megabytes RAM

-

2x or Greater CD-ROM Drive

Product Technical Support

Technical Support: Purchase includes free technical support via e-mail.

How To Order:

- Internet - to order via the Internet*, click on the appropriate selection below.

|

|

|

||